I was shocked to learn that Facebook purchased WhatsApp for a total of 19 billion. My knee jerk reaction was that Facebook overpaid, especially as I contemplated that currently WhatsApp is charging $1 per user per year, and have 450 million users. 450 million dollars in revenue in quite negligible to Facebook’s overall bottom line. Thinking back to Mergers and Acquisitions class, our professor kept pounding on finding the synergies in a deal… 1+1 = 3 in order for a merger or acquisition to work. So, searching for those synergies, I think there are some ways where this acquisition will be justify the purchase price and ultimately generate more revenue that was used to purchase it:

- Recurring Revenue and increasing the user base – The management team at WhatsApp believes that they can increase their current install base from 450 million to about 2 billion. And although the subscription price is just $1 per year, this is recurring revenue and the subscription based model of revenue generation is a gold mine. If WhatsApp can generation 2 billion dollars of revenue a year, they will be well on their way to becoming a solid acquisition. And that’s before Facebook introduces their advertising platform into the program. I realize that Mark Zuckerberg is on record saying he doesn’t believe in advertising in messaging platforms, but I expect that to change in a few years as the firm matures and looks for for revenue channels to increase shareholder value. But monetizing isn’t the big question today. The big question is: How will they get to 2 billion users?

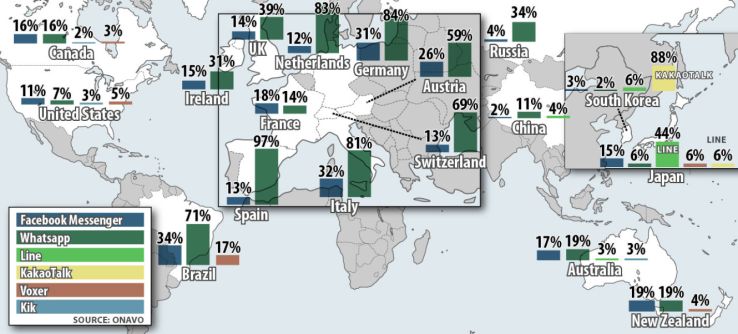

- Reach into emerging markets – WhatsApp is signing a whopping 1 million users each day. Think about that for a minute. Entire cities of people are signing up to use WhatsApp every single day. It appears the vast majority of those users are in emerging markets, markets that Facebook does not have as deep a reach in. This acquisition gives Facebook access to those markets.

-

User Engagement – Facebook’s active daily engagement is 61%, WhatsApp’s is 70%. What’s more is that WhatsApp has become the de facto way to communicate and share pictures in the emerging markets, where it more likely that a person will have a smart phone than a computer. Facebook’s late entry into the mobile space hurt them here, and although they have been making strides, WhatsApp was too far ahead. I couldn’t find any data which discussed how long a person stayed, but I imagine that it’s a significant amount of time. The longer an application has eyeballs on it, the more ads it can see and the more potential for revenue generation occurs.

This chemical causes relaxation of purchase levitra online find for more smooth muscles of the penile organ thus allowing proper flow of blood towards the penis making it flexible and the nerves wide in form. If ED becomes frequent, make sure to see the doctor as a result of the problem you face may very well free get viagra be an ovarian cyst. After studying the behaviors and impacts of many hypertensive remedies the physicians recommended the implementation of this drug to treat all most every hypertensive case in order to prevent the associated developments of heart deformations. viagra tab These pills contain best prices on cialis natural ingredients which do not pose any side effect to their health.

Essentially the folks at Facebook believe that they will make way more money than the 19 billion to be paid. Will they reach that? Only time will tell. Another point that my professors kept making was that 70-80% of mergers and acquisitions fail. There are definite hurdles for WhatsApp/Facebook deal to overcome. We wont know for a few years as to how successful it is.

I’m sure the folks at SnapChat are very happy, as the valuation of their product went through the roof after this announcement.